“I believe there’s a huge difference between housing as a commodity and gold as a commodity. Gold is not a human right, housing is,”

says Leilani Farha, a former Special Rapporteur appearing in the documentary film, ‘PUSH’.

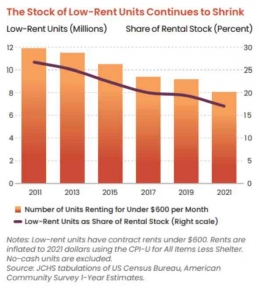

Have you ever wondered why people kept complaining about not being able to afford a home? The housing crisis has long been acknowledged as a major issue by people worldwide, yet it still exists, even worsened. A popular scapegoat being held accountable for the severity of this issue is large property investors feeding on the current paradigm prevailing in the housing market, which is the financialization of housing.

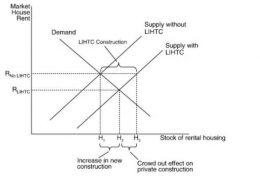

Housing financialization has been described as treating housing as a commodity to generate profits rather than social goods that bear the importance of fulfilling the human need for shelter. Then one question concluded, how did this idea become popular in the first place? Several studies trace the mainstreaming of this concept back to the housing boom and the Great Recession of the United States.

Where It All Started

During the 1990s, the US began an expansion in home mortgage borrowing, which made it easier for households to acquire housing credit. During this period, mortgage debt went through securitization, repackaging those mortgages into bond-like investments that are no longer at risk of being unpaid if the homeowner defaults. This process resulted in products such as mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), marking the shift from viewing housing as a place to build a home to viewing them as a financial asset that could be traded easily (Federal Deposit Insurance Corporation, 2023).

With securitization, lenders are now more loosely selective with their lending, giving them to many under-qualified borrowers. Big investors would also come into play when the MBS and CDOs are equipped with higher interest rates and yield greater returns. All in all, as long as house prices are increasing, the housing market is highly profitable.

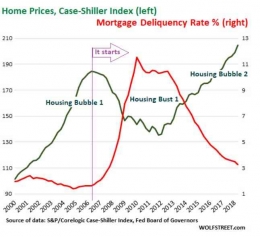

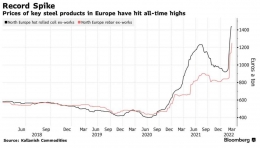

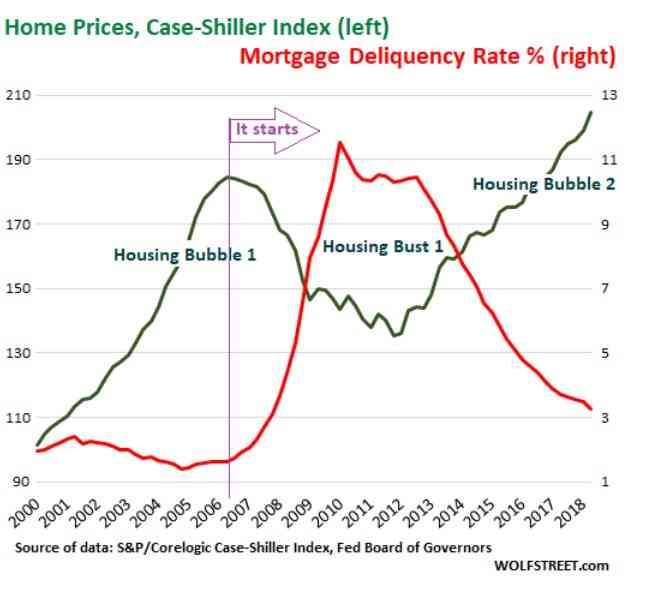

However, in Figure 1, we can see that home prices started to decrease while mortgage interest rates were high. Many homeowners would then default as indicated in the mortgage delinquency rate, and can no longer use the profit from selling their house to acquire a new one. The US housing bubble burst and triggered an economic shock to other countries, creating a Global Financial Crisis (GFC) that would stimulate instability in housing markets and a decline in house constructions globally.

How GFC Shaped Today’s Realities